PSIRS Hosts Two-Day Stakeholders’ Engagement on 2025 Nigeria Tax Reform Act

The Plateau State Internal Revenue Service (PSIRS) has rounded off a two-day stakeholders’ engagement aimed at strengthening public understanding of the 2025 Nigeria Tax Reform Act. The session was held at the Usiju World Event Centre in Jos.

The event gathered professional stakeholders from ministries, departments, agencies, private businesses, the informal sector, and civil society groups. Its core objective was to clarify the new tax reforms and explain their implications for effective tax administration across Plateau State.

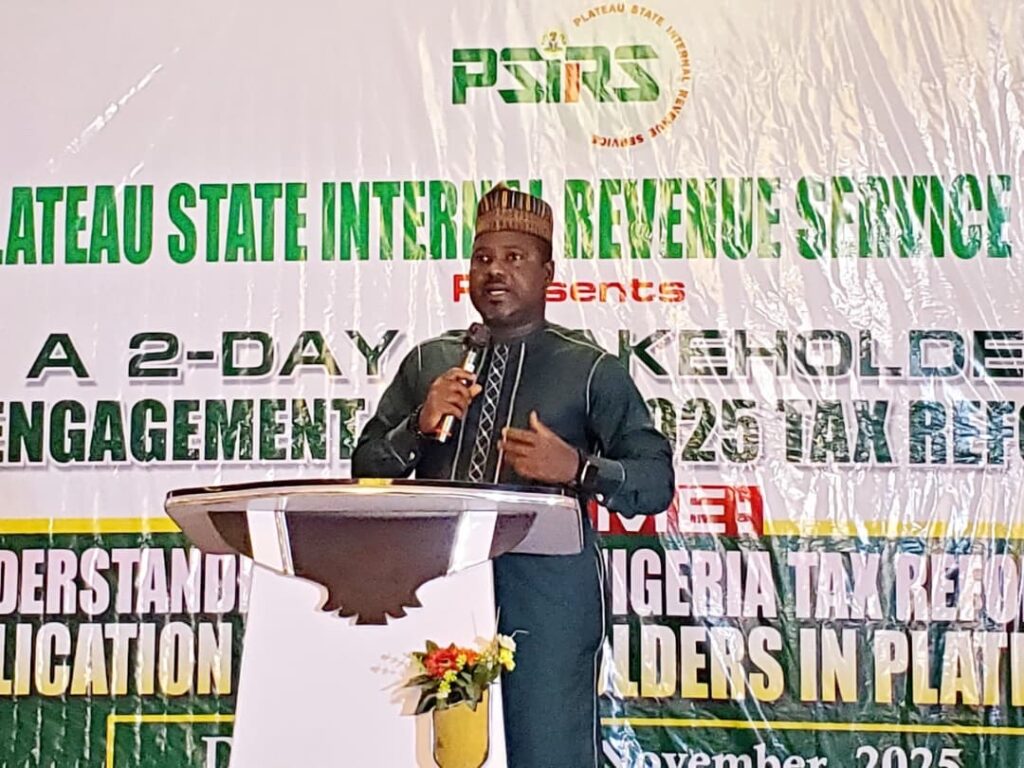

Delivering the welcome address on behalf of the Secretary to the Government, Arc. Samuel Nanchang Jatau, PSIRS Chairman Dr. Jim Pam Wayas noted that the 2025 Tax Reform Act affects every citizen and takes effect from January 1. He emphasized that the reform is not punitive but introduces a unified fiscal framework that streamlines tax administration across all government tiers and strengthens revenue service autonomy. He encouraged participants to seek clarity and dispel misconceptions ahead of implementation.

Dr. Wayas also provided a detailed overview of the Act, explaining how it consolidates existing tax laws into a single structure. Key changes include updates to personal income tax, VAT, capital gains tax, and minimum tax regulations. Small businesses enjoy a higher zero-rate threshold, while capital gains tax will now be applied at rates between 10% and 25%. He added that financial institutions must report collective income directly to revenue services, making compliance easier.

Speaking on the legal implications, the Plateau State Commissioner of Justice, Hon. Philemon Daffi Esq., urged stakeholders to comply fully with the new law. He assured that tax revenues would be used responsibly and encouraged the informal sector to promote understanding and compliance, adding that enforcement would be firm when necessary.

Mr. Jonathan Mangai, Director of Planning, Research, and Statistics at PSIRS, stressed the importance of a fair, transparent, and accountable tax system. He highlighted the need for integrity, efficient digital processes, and stronger connections between taxes paid and public services delivered.

A panel session featuring Dr. Jim Pam Wayas, Mrs. Rahila Olu-Silas Esq., Assoc. Prof. Dagwom Dang, Mr. Monday Bereh, and Dr. Lukman Jimoh Rahim moderated by Mr. Wulashik Dafaan and MC Tsok explored the New Nigeria Tax Law and the challenges of implementation. Discussions focused on expanding tax coverage, strengthening compliance, and ensuring fair contributions from both the financial and non-financial sectors.

Dr. Lukman Jimoh Rahim addressed the informal sector specifically, reiterating that all income including cryptocurrency gains—is taxable. He broke down the tax bands, noting that the first ₦800,000 of income for registered businesses is tax-free, while higher earnings are taxed progressively. He encouraged participants to share the knowledge gained and referenced a pocket-friendly guide and online portal for ongoing support.

Hon. Cornelius Doeyok, Commissioner for Tourism, Culture, and Hospitality, called for continuous citizen engagement to enhance understanding and acceptance of the new tax law. He highlighted plans to harness tourism, hospitality, and e-commerce to boost state revenue.

In her closing remarks, Mrs. Deborah Adamu Kesuwo, Chairperson of the stakeholders’ engagement team, thanked participants for their active engagement and praised the resource persons for their insightful contributions. She also commended Dr. Wayas and his team for their commitment to transparency and efficiency in Plateau State’s tax system.

Mrs. Emily Ufulul Daboer, delivering part of the vote of thanks, expressed appreciation to all stakeholders, taxpayers, partners, and the media for their dedication to understanding the Nigerian tax system and supporting PSIRS initiatives.